Risk Portfolio

You could be married, divorced or just starting out in life, and even the basic things in life cost money. You will need a roof over your head, a vehicle to help you to earn an income, household items, internet access and a computer. The impact on your quality of life and ability to work cannot be overestimated. The most prominent problem is a home. Banks in general provide more favourable terms should two parties – like a couple – sign on the dotted line. Why is this? If something happens to one of the partners, the other partner takes on the liability and must then pay the bond. But if you are the remaining party, you will have to pay the bond on a smaller income (compared with the combined income).

The other single largest expense here will be a motor vehicle. It is crucial in ensuring that you can get to and from work as required.

The purchase of all these items will add to your debt levels and will have a substantial effect on your financial vulnerability. But there are ways to minimise the risk and ensure that you will be in a financially secure position in the future. The first and most important step is to live within your means and purchase a house or car that you can comfortably afford. The luxuries of a more expensive house are quickly offset when you have a gaping hole in your bank balance.

The same applies to a motor vehicle.

The next step is to secure these assets for both your future and the future of your dependants. Taking insurance cover to settle any debts (car, loans and credit cards) as well as your bond is highly recommended. This will ensure that your dependants will be cared for should something happen to you. When it comes to the structuring of such insurance it is best to contact us to ensure that all your needs are taken into account, as well as other nitty-gritties such as tax and liquidity concerns.

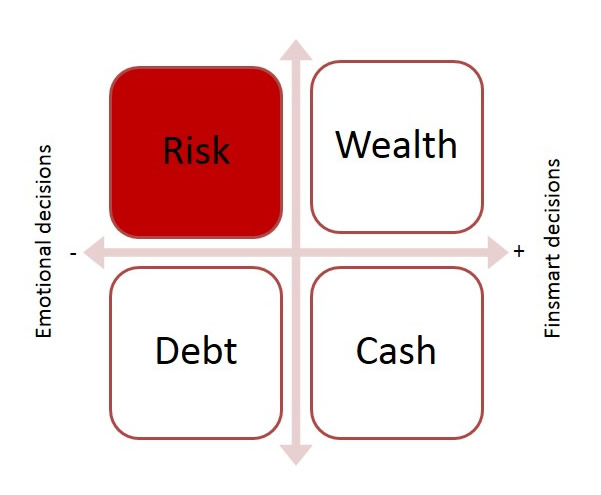

The risk block can be divided into:

- Short-term insurance to cover your house, household contents and vehicle

- Medical aid

- Life insurance

- Disability insurance to pay you a lump sum amount in case you are not able to work (this can be used to settle debts or you can invest it and draw an income from it)

- Disability income protection to cover your salary should you become permanently disabled (this type of cover normally pays until retirement age); and

- Severe illness insurance to pay you a lump sum in the event of a debilitating illness like cancer or a stroke.

You may never had a claim on your short-term cover for your entire life but cancel the policy and it is highly likely that your house will be broken into while you’re busy reporting your bumper bash at the local police station. To avoid such a situation and to protect one of your most valuable assets – your car – be proactive and make sure both your car and household contents are insured.

One can easily justify that medical aids are just not affordable. Instead of cancelling your medical aid rather consider a lower-cost option combined with a GAP cover.

Life cover and severe illness and disability cover are so important. While you will never see the benefit of life cover directly, it will ensure that your children will not be left destitute in the event of your death, and that debts are settled after your passing.

With disability and illness cover you are guarding against adverse events that can undo all the plans that were previously put into place. Severe illness cover will ensure that you have a better chance to get well and you will not lose your property or other assets. Contrary to popular belief, belonging to a medical aid is not enough when it comes to the shock event of a traumatic, severe illness. This risk can be hedged with an appropriate severe illness product. The playouts of such a policy can be used to ensure that all medical costs are covered.

Should you become disabled, some employer funds will pay 75 per cent of your salary before tax until retirement age. Make sure that you protect yourself against any shortfalls if this cover is not in place. When it comes to disability cover, it is very important to know what you have signed up for because there is income-based disability and lump-sum-based disability. Lump-sum cover is used to fund the immediate cost of adapting your surroundings to your disability. Examples of this are converting your car so it can be operated with your hands only or installing a stair lift in your house. The most important aspect of this cover is that it is only paid if the disability is permanent.

In general, income-based cover allows you to meet your monthly obligations and to continue functioning as normally as possible. What makes this type of cover unique is that it is payable on both temporary and permanent events, making it more comprehensive than pure lump-sum cover.