Emergency Cash

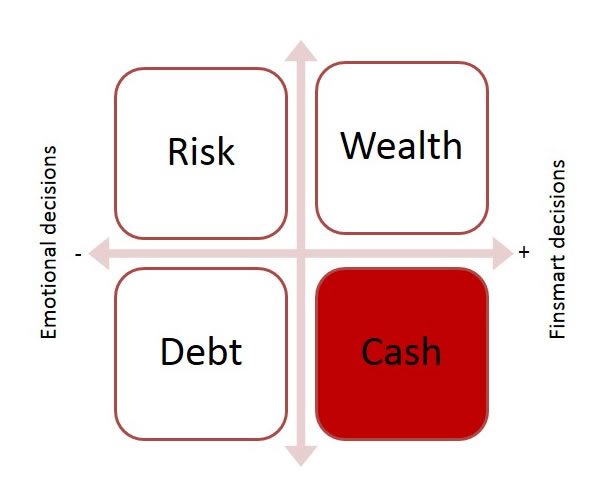

Having a stockpile of emergency cash means you don’t have to turn to expensive, short-term loans when a crisis hits. Repaying these loans means cash will always be going out of your purse while you try to repair your finances. If you don’t have emergency cash, you are going to make an emotional decision when you have an emergency and you will land up in debt. We suggest you should have an easily available amount in your emergency fund equal to at least three to six months of your monthly salary.

This is money for a real emergency when need to repair your car’s gear box or if you are unemployed for a short period, so how do you set up an emergency fund?

You do not have a bond

If you earn R21000 per month, take R500 a month and put it in a money market fund, you can open a money market fund at your bank. A money market fund is a low-risk investment with no exposure to volatile share prices but keep in mind there is also n guarantee on your capital. Build this R500 into your monthly budget and sign a debit order if you have to.

Per month, R500 is 2.6 per cent of you salary or one fewer dinner-and-a-movie treats. In 12 months’ time you will have saved R6 000. Repeat this strategy for another year and add half of your bonus if you can. After two years you should have more than R12 000 in your fund.

Now consider moving your emergency cash to a stable or defensive unit trust fund. A stable fund will have 15%–25% of your money invested in the stock market. (Generally, the more the equity, the higher the risk.) A stable or defensive fund will target shares that are not likely to suffer too much in a downturn. You will need a financial adviser to help you with the choice of investment because you should be able to access this capital quickly and you cannot run the risk of your money being depleted if the stock market has a downturn just before you need it. It is after all an emergency fund. You should get a higher return in a unit trust than a money market investment.

You have a bond

If you have a home loan on your property, put your emergency cash into your bond every month. You get a guaranteed tax-free return of whatever the interest rate your bank charges you on the bond. This will not only save you a bit of interest but if you do not need to access the emergency fund, you will pay off your bond sooner.